An Emergency is defined as unexpected, and often dangerous situation requiring immediate action . In today’s unpredictable world, having a robust emergency fund is more important than ever. Whether it’s a sudden medical expense, unexpected car repair, or a job loss, a well-funded emergency account can provide the financial cushion you need to navigate life’s uncertainties. But building and maximizing this fund can be challenging. Among a multitude of strategies available here are ten smart strategies to help you grow your emergency fund effectively.

1. Set Clear Savings Goals

The first step in building a substantial emergency fund is to establish clear savings goals. Determine how much money you need to cover three to six months of living expenses, depending on your personal situation. This amount will vary based on your monthly expenses, including rent or mortgage, utilities, groceries, and other essentials. Once you have a target amount, break it down into manageable milestones. For example, if your goal is $6,000, aim to save $500 a month for a year. Setting specific goals helps maintain motivation and allows you to track your progress.

2. Create a Budget

To allocate funds toward your emergency savings, you need a clear understanding of your income and expenses. Creating a detailed budget is essential for this. Start by listing all your sources of income and fixed expenses, such as rent, utilities, and loan payments. Then, include variable expenses like groceries, entertainment, and dining out. By analyzing your spending patterns, you can identify areas where you can cut back and redirect those savings into your emergency fund. Utilize budgeting tools or apps to track and manage your finances efficiently.

3. Automate Your Savings

One of the most effective ways to ensure consistent contributions to your emergency fund is to automate the process. Set up a direct deposit from your paycheck into a separate savings account designated for emergencies. This way, you treat your savings like a fixed expense, and you’re less likely to spend the money. Automating your savings also removes the temptation to spend the money you intended to save, making it easier to stay on track.

4. Cut Unnecessary Expenses

Review your monthly expenses and identify areas where you can cut back. This could include canceling unused subscriptions, reducing dining out, or finding cheaper alternatives for your regular purchases. Redirect the money you save from these cutbacks into your emergency fund. For instance, if you cut out a $50 monthly subscription, deposit that $50 directly into your emergency savings account. Small sacrifices can add up quickly and significantly boost your savings over time.

5. Increase Your Income

Increasing your income can accelerate the growth of your emergency fund. Look for opportunities to earn extra money, such as taking on a part-time job, freelancing, or selling unused items. Even small amounts of additional income can make a significant difference when added to your savings. Consider leveraging your skills or hobbies for extra cash. Be creative and open minded . You can leverage what you already have such as a car to do delivery or your computer to do translation if you speak another language. Other example, if you have a knack for writing or graphic design, you could take on freelance projects in your spare time.

6. Utilize Windfalls

Whenever you receive unexpected money, such as a tax refund, work bonus, or inheritance, consider allocating a portion or all of it to your emergency fund. Windfalls provide an excellent opportunity to make substantial contributions without affecting your regular budget. For instance, if you receive a $1,000 tax refund, consider depositing it entirely into your emergency savings. This approach helps you grow your fund faster and can be a great motivator.

7. Cut Back on High-Interest Debt

High-interest debt, such as credit card debt, can drain your finances and make it harder to build an emergency fund. Prioritize paying off high-interest debt to free up more money for savings. Start by focusing on one debt at a time, using methods like the snowball or avalanche approach. Once you reduce or eliminate high-interest debt, you’ll have more financial flexibility to increase your emergency fund contributions.

8. Choose the Right Savings Account

The type of savings account you use can impact the growth of your emergency fund. Look for accounts that offer higher interest rates and minimal fees. High-yield savings accounts or money market accounts often provide better interest rates compared to traditional savings accounts. Research various options and choose an account that aligns with your financial goals. Remember, the goal is to grow your savings efficiently, so select an account that offers both safety and reasonable returns.

9. Review and Adjust Regularly

Your financial situation and goals may change over time, so it’s essential to review and adjust your savings plan regularly. Set aside time each quarter or at least once a year to assess your progress, re-evaluate your budget, and adjust your savings goals if needed. Life events such as a new job, salary increase, or changes in expenses can impact your savings strategy. Regular reviews help you stay on track and ensure that your emergency fund continues to meet your needs.

10. Build a Savings Habit

Building a habit of saving regularly is crucial for the long-term success of your emergency fund. Consistency is key, so make saving a part of your routine. Even if you can only contribute a small amount each month, the habit of saving regularly will help you accumulate a substantial fund over time. Celebrate milestones and progress to stay motivated. The more consistent you are, the more likely you are to reach and maintain your emergency savings goals.

Conclusion

Maximizing your emergency fund is a vital component of financial stability. By setting clear goals, creating a budget, automating your savings, and cutting unnecessary expenses, you can effectively grow your fund. Increasing your income, utilizing windfalls, and choosing the right savings account can further enhance your savings efforts. Regularly reviewing and adjusting your plan ensures that you stay on track, while building a consistent savings habit solidifies your financial security. With these strategies, you can build a robust emergency fund and safeguard yourself against life’s unexpected challenges and lead you to financial freedom .

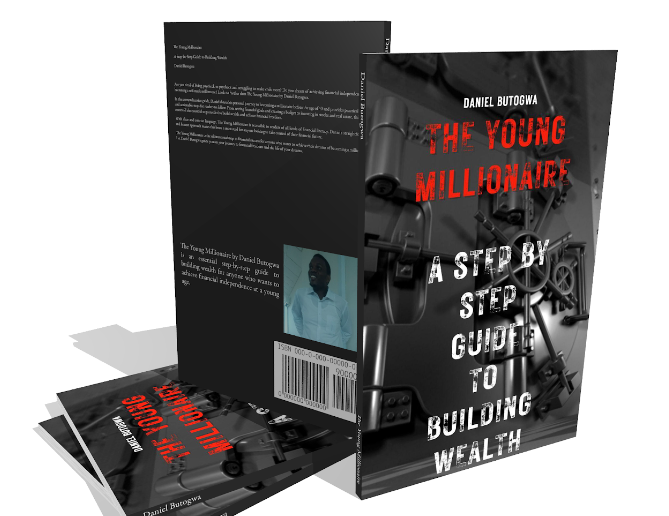

If you want to learn how to be a millionaire at a young age and achieve financial freedom , The Young Millionaire e-book will give you step by steps process to reach that goal !